Contents:

This is by no means an exhaustive list of the business valuation methods in use today. Other methods include replacement value, breakup value, asset-based valuation and still many more. These similar businesses, often referred to as “comparables” or “comps,” can orient you within the marketplace and provide context about the sector. Knowing your peer companies will also help you assess your market share and growth potential. Then, you can demonstrate to potential buyers what makes your business stand out. Business model demonstrates how you make money, be it a subscription-based service, direct-to-consumer e-commerce, or B2B consulting.

The process often includes a review of your financial statements and other internal documents as well as a marketplace analysis and competitive assessment. In addition to being needed for strategic planning purposes, business valuations are especially helpful if an ownership transition event looms in the foreseeable future. A professional valuation can help you understand the worth of your business in both strategic buyer and financial buyer settings. The food business plan excel covers assumptions related to the total startup expenses a business requires to effectively start and run the company.

Corporate Planning

But it’s very important for you to be able to quantify your business’s worth when approaching equity investors so you can get the best deal possible. We have been working with VCs and PE firms for almost 10 years and can leverage our valuable experience gained while working with them to most accurately evaluate your business’s worth. We use a combination of different techniques to estimate the most reliable and reasonable valuation for your startup. The income approach to business valuation determines the amount of income a business can expect to generate in the future.

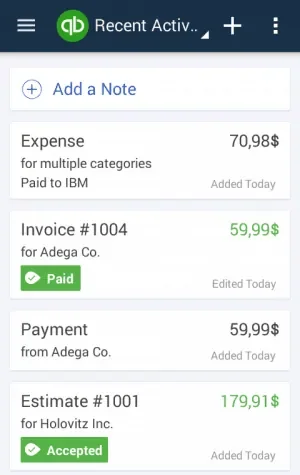

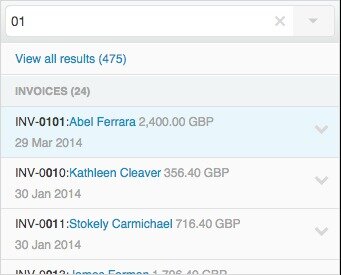

For public xero community 2 million subscribers, annual and quarterly financial reports are typically accessible online. Depending on the degree of corporate transparency, you can also see what comparable businesses are selling for. Internet companies or buyers interested in the tech sector can use online directories like Crunchbase and platforms like AngelList, which provide information about startups, funding, investors, and more. Before even thinking about how to value a small business for sale, both sellers and buyers should organize their financial records — that’s crucial for accurate calculations. And beyond conducting your valuation, you’ll need your finances in order to transfer business ownership, regardless.

What business valuations are and how to do them

This means that the overall number of shares increases, which then dilutes the original shareholders portion of the pie. A business valuation is the first step for you, as a business owner, to successfully plan, grow, and exit your business. This is calculated by subtracting the company’s total liabilities from its total assets. This asset-based valuation method reviews the operational-related assets of a business and assigns a value based on what it would cost to replace them. There are several types of business valuations, including Market Capitalization, Earnings Multiplier, Times Revenue, Discounted Cash Flow, Replacement Value, and Breakup Value.

Ultimately, the value of any business is the present value of expected future profits. The valuation process looks in depth at the operation, expenses, revenues, strategy, and risks of the business to arrive at assumptions for future earnings, time horizon, discount rates, and growth rates. An established business with steady profits may use the capitalization of earnings method to determine future profitability.

Advertising online drastically expands your market reach and builds up your presence. Here are the reasons why business valuation is a must for businesses. Stock Bonuses and Purchases, Phantom Stock Plans and Stock Appreciation Rights Plans and other forms of Non-Qualified Deferred Compensation Plans can all be structured using the valuation. These incentives are in place to encourage employee performance and improve the company’s total worth. If the firm requires a boost, these incentives might bring the overall value up to the level required for a successful exit. Why Next-Generation Family Business Planning May Not Be Easy With growing concern over next generation buy-in, it is time to look at how you can create a successful succession plan that doesn’t involve family.

However, you may need to value your firm under the following circumstances. Usiness valuation is an essential aspect for any entrepreneur looking to grow their business. However, ascertaining a business’ value can be a precarious task, especially when you’re a startup without much evidence to work with. We use a combination of different methods to arrive at a reasonable range of valuation estimates for your project.

A business valuation helps company leaders formulate a plan to move forward toward their goals. With a correct valuation in hand, a company can make accurate forecasts of revenues, determine future operating expenses, and understand upcoming capital requirements. Comparing these metrics to other similar companies in the sector offers even more insight into the business’s potential for growth. A business valuation might include an analysis of the company’s management, its capital structure, its future earnings prospects or the market value of its assets.

As we mentioned earlier, a business’s SDE multiple — and the method of valuation — varies according to a few factors, including the strength of the industry. So, sellers should find out as much as they can about companies that are similar in size, business model, and revenue, if that information is available. The program will cover owner readiness, business readiness, market readiness, exit options, the sales process, and legal and tax consequences. Participants will know their choices and learn about realistic expectations and consequences with transferring ownership.

Take stock of your assets

When your company is ready to go through a business valuation, there are three major approaches. Each one has its own benefits to consider, so it’s wise to evaluate which is best for you and your business. Start-up or early-stage businesses are especially hard to value, due to the lack of a track record.

Nonetheless, one could easily find the precise https://bookkeeping-reviews.com/ rate and use that. If one accepts 10% as the correct rate without growth, then the correct rate with 5% growth that would discount the cash flows with growth to the $1,600,476 present value turns out to be 15.50%. Similarly, if one accepts 15% as the correct rate with growth, then the correct rate without growth that would discount the constant cash flows to the $1,628,604 present value turns out to be 9.52%. When multiyear analysis is used, a growth or inflation factor should be considered in some way. If growth is completely ignored in the above example, the present value of a $300,000 annual cash flow discounted at 15% would be approximately $1,350,000.

Efficient-market investors believe the market accurately reflects value. Value and price investors use active management styles, by selecting specific stocks with a goal of outperforming the market. Efficient market investors use passive investment styles, such as index funds.

- The Internal Revenue Service uses a business’s fair market value to oversee tax-related events like gifting of shares or a company’s sale or purchase.

- Valuation is used by financial market participants to determine the price they are willing to pay or receive to affect the sale of a business.

- The price negotiated by well-informed, willing, and able buyers and sellers who are not compelled to act.

- The business valuation rule of thumb is a quick measurement based on a single part of a company’s income stream, depending on the industry it operates in.

- They will then look at the nature and background of the business, its products and services, as well as the industry life cycle, economic and political environment.

When using an entrepreneur’s forecasts, the analyst typically tries to neutralize the entrepreneur’s optimism with a high discount rate. A high rate reflects both the degree of risk involved and the expectations of capital providers for high returns to compensate for the risk. VCs might seek rates of return of 50% or more during the seed capital stage and 30–50% at later stages. The net asset value is obtained by first adding the values for fixed and current assets at market prices. These include balance sheet items of a tangible and intangible nature.

With a few key details, your business valuation experts can provide an estimated cost upfront. A business valuation determines the economic value of a business, either in full or in part. Knowing the company’s worth offers the business owner a wealth of data and statistics. The worth is measurable through market competition, asset values, and income. Ultimately, successful business owners should always identify a reliable and independent business valuation of their company before creating an exit strategy and selling it. In many cases, especially when an insider is involved, accredited or certified business valuation professionals are essential.

If possible, use at least two methods for the business valuation and look at the company value from several angles. This will give you a sense of the possible range of enterprise value and what it depends on. It’s not always in the entrepreneur’s best interest to maximize its value at this stage if the goal is to have multiple funding rounds.

This is another opportunity to seek the counsel of a mentor or a professional advisor, who can provide insight into your business’s assets from a more objective perspective. Your particular business’s SDE multiple will vary based on market volatility, where your business is located, your company’s size, assets and how much risk is involved in transferring ownership. The higher your SDE multiple, as you might expect, the more your business is worth. To be credible, valuations must be undertaken by impartial third parties.

It is a lot easier to engage in risky maneuvers when someone else’s money is at stake, but a lot harder to justify and deal with the potential fallout. A higher valuation may seem like more dollars to work with, but it generally results in far less flexibility. Review these answers to some of our most frequently asked questions for more insight.

Microturbine Market: The Microturbine Market Size is to Attain a … – Digital Journal

Microturbine Market: The Microturbine Market Size is to Attain a ….

Posted: Fri, 17 Mar 2023 06:46:46 GMT [source]

Sensitivity analysis addresses the question of how much difference in the outcome results from different assumptions. The more sensitive the outcome, the less confidence we should place in the result. It is more art than science, with the skill and insight of the valuation expert playing an important role. Ownership interests in nonpublic companies almost always are discounted for the lack of marketability. A mix of different methods, run several times with varying scenarios, gives a sense of the possible range of company value. The total value of the firm from the perspective of equity and debt investors.